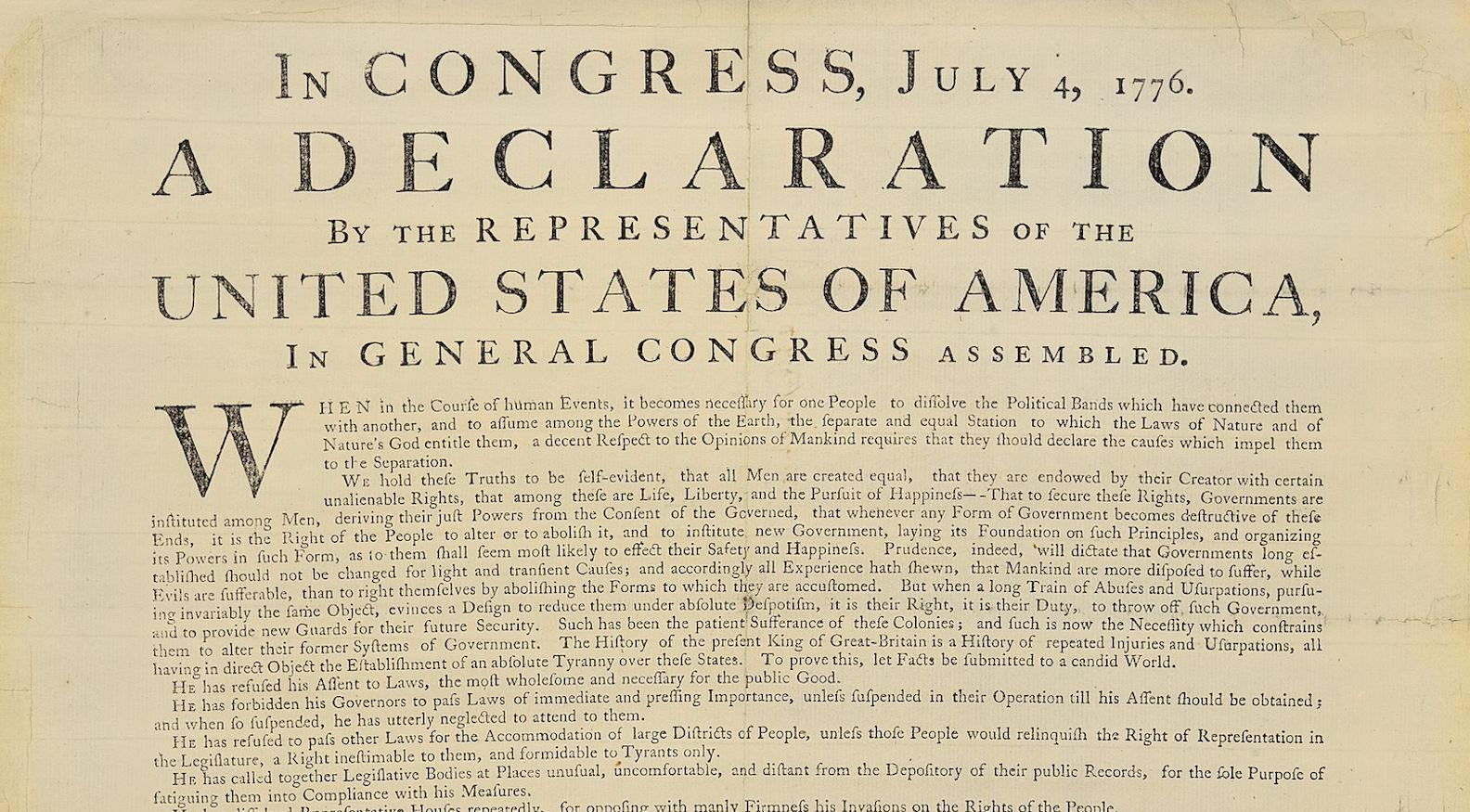

Detail of a Dunlap Broadside, The Declaration of Independence. Printed in July 1776. Library of Congress, Washington D.C.

Rally—a trading app that has grown, alongside a general fervour for collectibles, in popularity over the last year—will offer 80,000 shares of a rare copy of the Declaration of Independence to the general public this month. Each share will be worth twenty-five dollars, making the initial offering two million.

The copy is a Walsh 15 Broadside—printed in July 1776 in Exeter, New Hampshire. This particular document is one of only twenty Walsh copies created and currently in private ownership.

Many broadsides of the Declaration were created by different printers in this period and hung in public spaces to spread word of The Continental Congress’ declaration that the thirteen American colonies were no longer subordinate to Britain or the monarch, King George III. Though the Revolutionary War was already more than a year in at this point and would go on more than seven years after, July 1776 was an important moment for the colonists and required strategic and thorough dissemination of information.

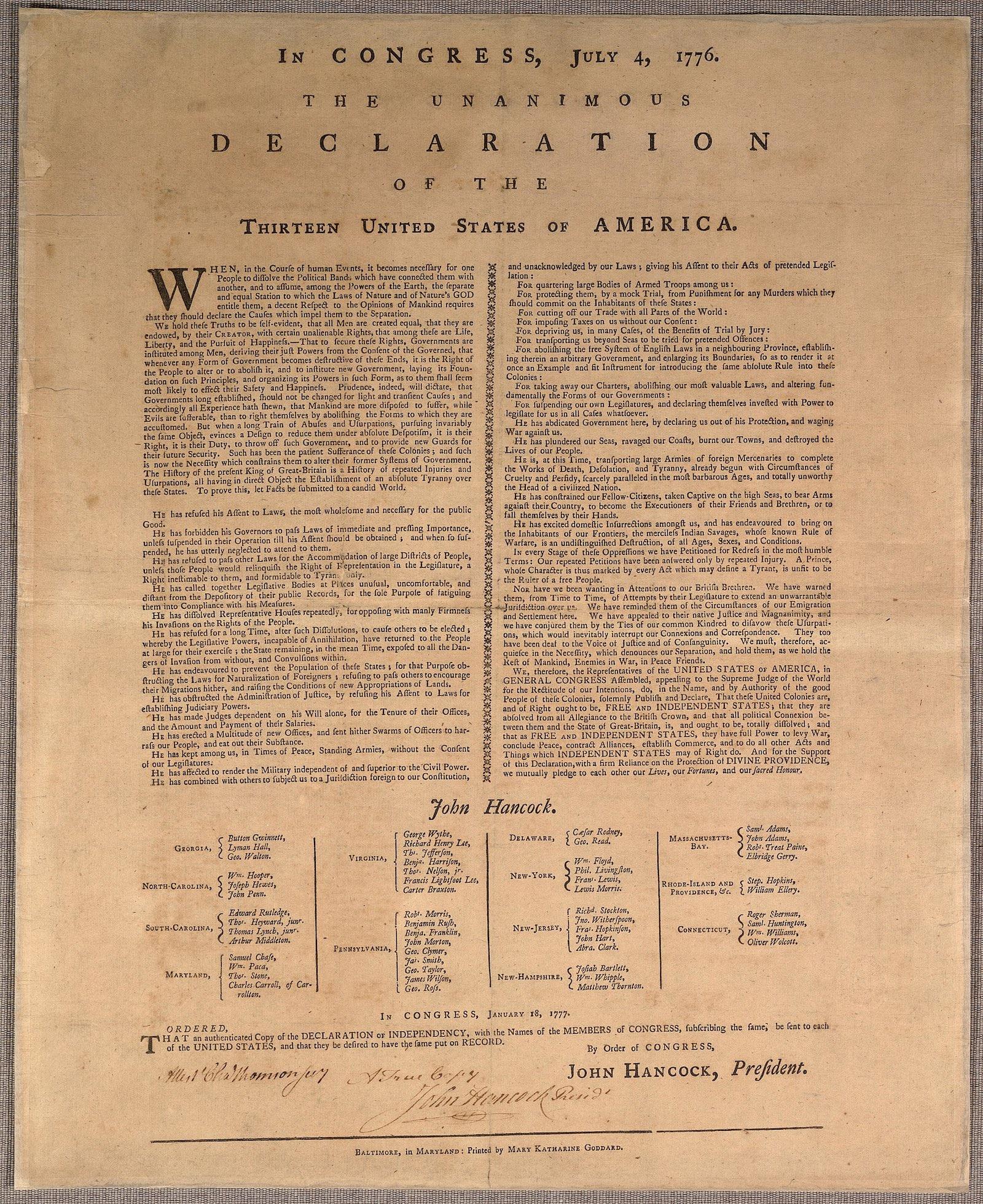

Goddard Broadside of The Declaration of Independence. Printed January 1777.

Congress commissioned and oversaw the printer Dunlap, a twenty-nine-year-old Irish immigrant, with the first round of broadsides. The type was set and the copies were printed the night of July 4, 1776. Though their exact number is unknown, it is estimated to be about 200.

In January of the following year, Mary Katherine Goddard became the second printer commissioned by congress to create broadsides. Her copies were the first to feature the signatures on the Declaration. After the initial Dunlap prints were made, states and private printers made and disseminated copies of their own. A unique four-column broadside resides in Lauinger Library of Georgetown University.

Collectibles, art, and the cryptocurrency bitcoin have skyrocketed over the course of the pandemic, something many are chalking up to larger concerns about inflation. As chief investment officer at Bleakley Advisory Group Peter Boockvar explained to CNN, “People are trying to get protection from the debasement of their dollars. They want to be in things with limited supply and that have the perception of value in the eyes of many.”

This application of an IPO on a collectible item comes just as the art world is adjusting to a storm of NFT offerings at some of the biggest auction houses. These same houses—including Christie’s, Phillip’s, and Sotheby’s—have also added forms of cryptocurrency to their list of accepted payment options. Could IPOs be the next big thing in the art world?

While this is certainly possible, there are risks. For one thing, collectibles don’t generate money. While this copy of the Declaration may go up in perceived value, it cannot create cashflow in the manner of a business. Collectibles may not be suited to function long term in a system designed for stocks and bonds.

Still, the sale is fascinating and something worth paying attention to over the course of May.